Just after Gavin Newsom was elected Governor, the San Francisco nonprofit SaverLife (formerly EARN) surveyed its California members—typically Black and Latino mothers who earn under $22,000 a year—about what the new Governor could do to help them. Surprisingly, “Lower the cost of local and state fines and fees,” was the second most common response.

So SaverLife—which helps people build savings to cushion against hard times—did a follow-up survey of its members across the state and just released the results. Fifty-four percent of respondents said that government fines and fees have caused their family a financial hardship.

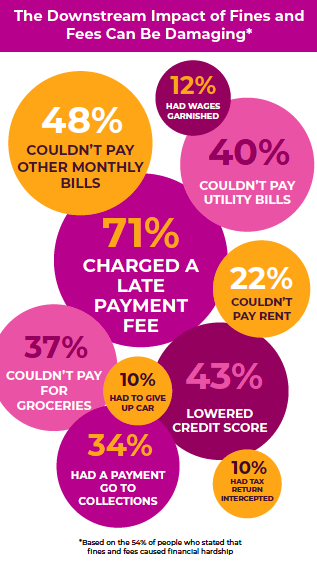

About half of these respondents said they had been unable to pay monthly bills because of fines and fees, like traffic fines, DMV fines, and court fees. Thirty-seven percent said they could not pay for groceries. Forty-three percent had their credit score lowered. Twenty-two percent could not pay rent.

The survey was done pre-COVID-19, but the results take on new urgency as record numbers of Californians file for unemployment and don’t know how they’ll pay their bills next month.

At the San Francisco Financial Justice Project, we have been taking a hard look at fines, fees, and financial penalties, especially those that are high pain for people—causing financial distress—and low gain for government, where the collection rates are very low. We have made fines more fair and gotten rid of fees that don’t make sense. We have eliminated or created low-income discounts for dozens of fines and fees. The reforms remove barriers for people that prevent them from succeeding. The solutions are doable for government to implement and are starting to spread to other places.

A movement for reform is growing to ensure our fines and fees are more fair, and ensure people at the margins don’t face a steeper penalty because of their poverty. The Debt Free Justice California coalition is working with Senator Holly Mitchell to advance the Families Over Fees Act, Senate Bill 144, to eliminate administrative fees charged to people in the criminal justice system. And we’re partnering with the Fines and Fees Justice Center and PolicyLink to launch Cities and Counties for Fine and Fee Justice.

During the last recession, to fill budget gaps, state and local governments dramatically increased their reliance on fines and fees. Low-income people and communities of color felt the brunt of this regressive form of taxation.

Let’s learn from our past mistakes. Let’s build up the financial reserves of people at the margins, but let’s also remember not to deplete them. It’s time for California policymakers to listen to SaverLife members and keep the government's hand from hurting the neediest.

We are proud to partner with SaverLife on this important research. We need to do everything we can to help families get back on their feet once this crisis is over, not bury them under fees and fines. Let’s take this opportunity to make lasting change.