Research and Reports

Research and Reports

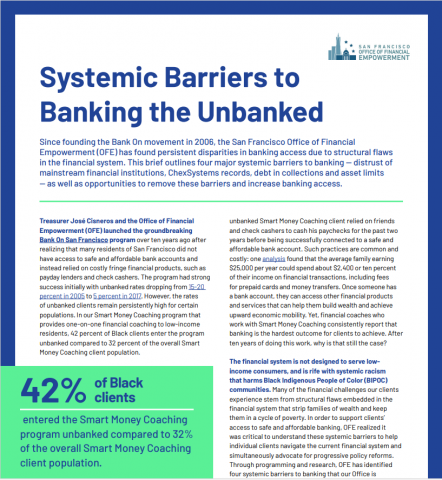

mainstream financial institutions, ChexSystems records, debt in collections and asset limits -- as well as opportunities to remove these barriers and increase banking access.

BankOn Client Testimonials

BankOn Client Testimonials

“Until Oct 15, 2022 I was homeless for 8 years... I had a healthy financial situation and good credit. But my third husband led to bad credit because he charged up high bills, didn’t pay our utilities, and other things I didn’t know about. Finally when we divorced, he was forced to pay those bills he racked up...My financial well-being was based on who I was married to and now I’m doing it for myself and I feel empowered to take ownership over my success. I opened a savings account and [now I feel like I can be more of] a normal functioning human being. I have a great handle on a budget now...I know how to handle that...If you don’t have control over your money and know where it’s going, you don’t have control over anything. The more I know the more I have control over it and it’s very empowering.”

A client was incarcerated for two years and prior to his incarceration, he had his bills automatically deducted from his bank account. While he was incarcerated, his bills stopped getting paid and as a result went into collections. After he was released...his goal was to open up a bank account and be able to save for emergencies. After just three coaching sessions, the client was able to open up both a checking and savings account.