![]()

Open a Bank On Account

Our Financial Counselors are happy to assist you with selecting the best account for you. Make an appointment with one today!

Get Started Here

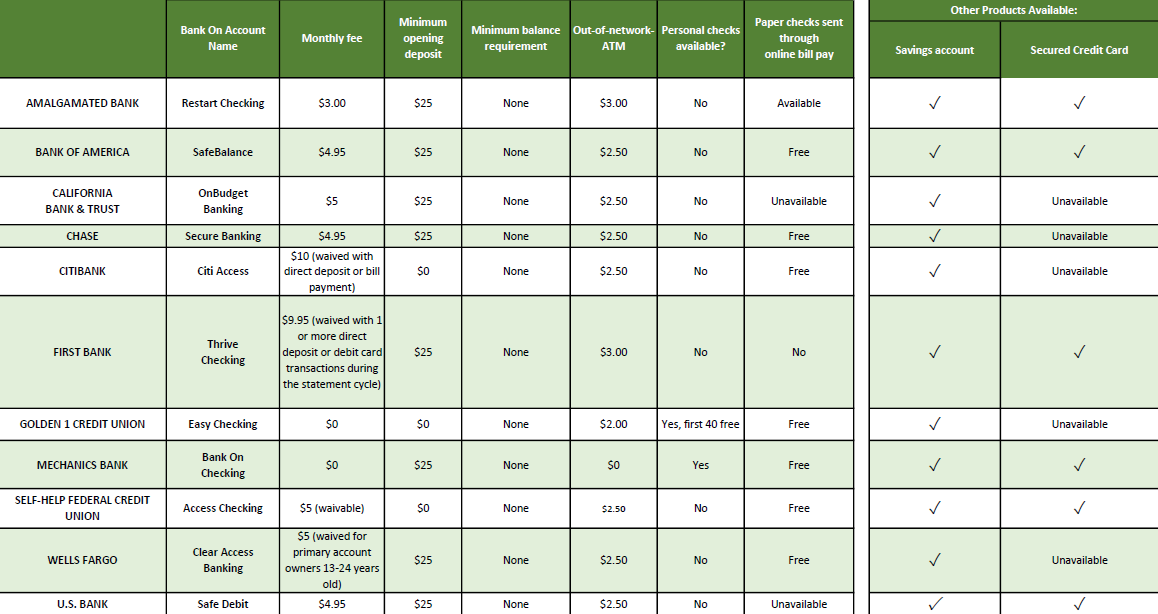

Bank Account Comparison

Everyone's situation is unique. See below for each institution’s enrollment requirements and to find out more about individual account features. Bank On recommends anyone who is new to the banking system or has had a negative experience with banking in the past, schedule a free and confidential appointment today with a certified financial counselor. Call: 877-256-0073.

Open a Restart Checking account with Amalgamated Bank.

Identification Requirements for Amalgamated Bank: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or a San Francisco City ID.

Banking History Requirements for Amalgamated Bank: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Charge off must not exceed $500, or it must be paid.

Open an Advantage Safe Balance Banking account with Bank of America.

Identification Requirements for Bank of America: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; Consular ID: Colombia, Dominican Republic, Guatemala and Mexico; or US non-immigrant visa and border crossing card with photo.

Banking History Requirements for Bank of America: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Past bank fees to Bank of America must be paid. Fees owed to any other financial institution within the past 12 months must be paid. Have fewer than 4 overdrafts or non-sufficient funds fees.

Open an OnBudget Banking account with California Bank & Trust.

Identification Requirements for California Bank & Trust: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or a San Francisco City ID.

Banking History Requirements for California Bank & Trust: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Past bank fees owed to any institution must be paid.

Open a Secure Banking account with Chase.

Identification Requirements for Chase: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or a Consular ID: Mexico.

Banking History Requirements for Chase: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Only past bank fees owed to Chase must be paid.

Open a Citi Access Banking account with Citibank.

Identification Requirements for Citibank: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or Consular ID: Mexico.

Banking History Requirements for Citibank: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Past bank fees owed to any institution must be paid.

Open a Imagine Checking with First Bank.

Identification Requirements for First Bank: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; Consular ID: Guatemala; or US Visa and Border Crossing Card.

Banking History Requirements for First Bank: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Charge off must not exceed $750, in total, from other financial institution(s). Past bank fees owed to First Bank must be paid.

Identification Requirements for Golden 1 Credit Union: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); U.S. Government or Military ID; Certificate of Naturalization; Employment Authorization Card; Refugee Travel Document; Matricula Consular Mexicana; Tribal ID (from federally recognized tribes); or a San Francisco City ID.

Banking History Requirements for Golden 1 Credit Union: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Unresolved defaults on any loan obligation to Golden 1, as well as failure to restore a positive account balance after overdrawing accounts with Golden 1, can affect eligibility.

Learn more about a Bank On Account with Mechanics Bank. Account must be opened in the branch.

Identification Requirements for Mechanics Bank: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or a Tribal ID.

Banking History Requirements for Mechanics Bank: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Past bank fees owed to any institution must be paid.

Open an Access Checking account with Self-Help FCU.

Identification Requirements for Self-Help FCU: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or San Francisco City ID.

Banking History Requirements for Self-Help FCU: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Past bank fees owed to any institution must be paid.

Open a Safe Debit Account with U.S. Bank.

Identification Requirements for U.S. Bank: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; or a Consular ID: Guatemala and Mexico.

Banking History Requirements for U.S. Bank: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Only past bank fees owed to U.S. Bank must be paid.

Open a Clear Access Banking account with Wells Fargo.

Identification Requirements for Wells Fargo: You will need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - only the number, not the card. In addition to an SSN or ITIN, you will need ONE of the following IDs: Any US state-issued ID with photo; Permanent Resident Card (Green Card); Any valid passport (foreign or domestic) with photo; Tribal ID; Consular ID: Argentina, Colombia, Guatemala and Mexico; Documento Unico de Identidad: El Salvador; Mexico Border Crossing Card; or Employment Authorization Card.

Banking History Requirements for Wells Fargo: Negative bank account activity can be reported to consumer reporting agencies called ChexSystems or Early Warning System. If you have a record in these systems, this can impact your eligibility for a new account. Institutions will not open accounts for individuals with fraud on their record. Only Mechanics Bank and Wells Fargo will consider opening accounts for individuals with suspected fraud on their record. Only past bank fees owed to Wells Fargo must be paid.

Community Financial Resources: Focus Prepaid Visa Debit Card - a safe alternative, for individuals who can’t or don’t want to have a bank account at this time. Note: The CFR card is not available online or at a branch and does require an SSN. Schedule a free, personalized financial counseling session through the San Francisco Financial Counseling program to learn more and get help with opening an account.

Non-Bank Apps: Some consumers may choose to use services without a bank charter, such as non-banks and financial app alternatives to a traditional bank account. Be aware that these alternatives may not have the same levels of consumer protection as a chartered financial institution offers, such as not directly insuring deposits. If you are considering these alternatives, find out more information about how they work and your rights and protections as a consumer here.