When a financial emergency strikes, you may be looking for a quick, relatively small loan to get you through to your next paycheck. Here are some things to think about as you look through your options, plus a calculator to compare the costs of different flat-fee loans.

Download our Loan Comparison brochure:English, Español | 中文| Filipino

1. Before Taking a Loan

- Get free financial counseling. Check out San Francisco Financial Counseling for free, confidential assistance with budgeting, credit building, and other financial counseling needs, including making a plan to pay back any loans within your budget.

- Consider other strategies:

- Ask current creditors for a payment plan, hardship assistance, or negotiating debt

- Take on extra hours at work or a side job to earn money

- Sell unneeded personal items through an online marketplace or a consignment shop

2. Where to Look for Short-Term Loans

- Beware of “Payday Lending.” These apps and services charge much more than banks, often annual percentage rates more than 400%!

- Your Bank. If you have a checking or savings account, ask your bank or credit union if they offer short term, smaller dollar loans. Several banks and credit unions have recently introduced these loans.

- Another Bank. If your bank does not offer such a loan, there may be options through other banks, credit unions, apps, and lenders who work with people with less-than-perfect credit. For instance, some credit unions offer “payday alternative loans” even to non-members.

- Community Options. Consider options offered by trusted community-based organizations, such as lending circles or tandas, where a small group of people contributes money every month and takes turns lending money to one another at no interest. When on-time payments are reported to the credit bureaus, lending circles can also help participants build credit.

- Credit Card or Payday Advance App. Consider these options, if available and more affordable than the alternatives, and if you’ll be able to repay them. Note: these options come with their own terms and conditions. A financial counselor can be helpful in understanding any confusing or harmful terms.

3. How to Compare Loans

For any loan you find, look at:

- Annual percentage rate (APR): APR is the interest charged per year of the loan. An APR over 36% is considered “high cost.”

- Fees: Some loans come with a flat fee of $5 or $10. Others may charge a fee like $6 per $100 borrowed. These $5 to $10 fees may seem reasonable, but consider them in the context of the amount you’re borrowing and how long you have to pay it back.

- Loan term: The loan term is how long you have to repay the loan.

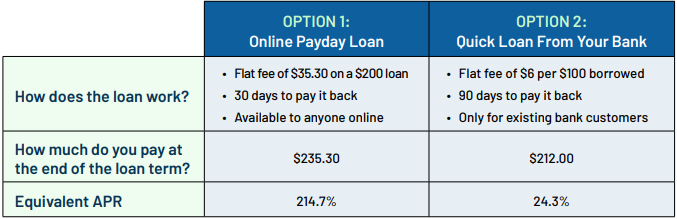

4. Example: Let’s Compare Two Types of Loans.

Imagine you need to borrow $200 to get through the month.

How do you decide between these options?

- If you’re unable to pay back Option 1 (the payday loan) in their 30-day loan period, the costs go up even more.

- Even though Option 1 looks appealing because it’s quick and they post their fees clearly, the cost ends up much higher than a similarly quick loan through a bank.

5. Try the Loan Cost Calculator

If you’re trying to decide on a loan that has a flat fee, use this tool to calculate the equivalent APR and compare different loan options:

Instructions: Enter a loan name, loan amount, fee, and loan term (in months), and the equivalent APR will calculate. You can use this tool to compare multiple loans with flat fees.

The actual APR may be different, depending on the actual amount you borrow and your specific repayment schedule.