Financial counseling has a significant impact for clients who are experiencing a pivotal life transition, such as exiting homelessness or starting a new job. Examples of life transitions financial counselors have supported include:

Searching for housing

Exiting the justice system

Finding a job

Starting a family

Confronting moments of crisis, like COVID-19

Moving to the United States

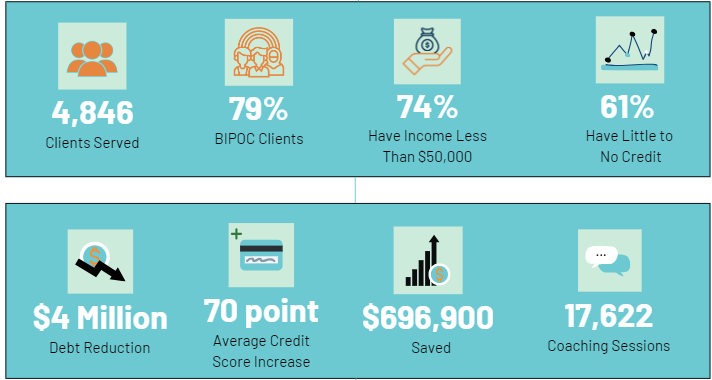

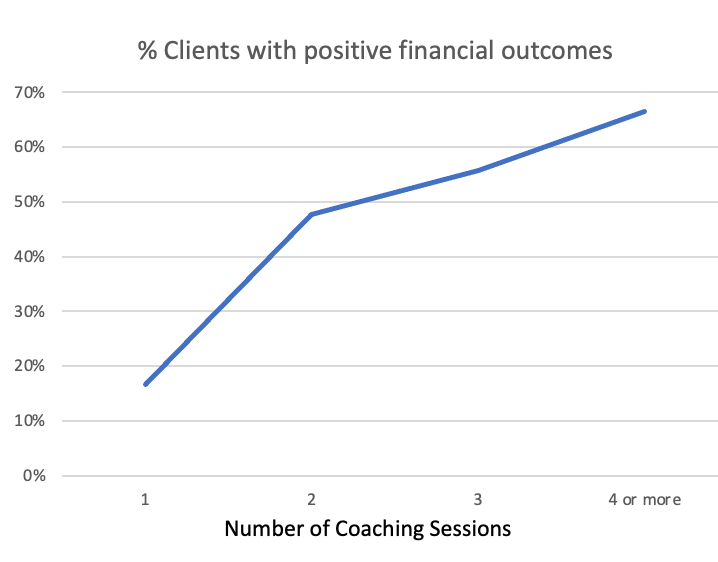

The more time clients invest in the program, the higher likelihood that they will achieve their goals!

Read Our Reports

Celebrating Impacts of Smart Money Coaching and Introducing a New Chapter.

Read five ways to create meaningful and life-changing financial outcomes for the community with this report from Smart Money Coaching.

In this report we tackle the unfair, unequal and opaque consumer banking systems that have blacklisted so many low-income consumers, immigrants, and in particular Black consumers from the financial mainstream.

Since founding the Bank On movement in 2006, the San Francisco Office of Financial Empowerment (OFE) has found persistent disparities in banking access due to structural flaws in the financial system. This brief outlines four major systemic barriers to banking -- distrust of mainstream financial institutions, ChexSystems records, debt in collections and asset limits -- as well as opportunities to remove these barriers and increase banking access. Read more here.

A joint report done with the California Reinvestment Coalition (CRC). As COVID-19 continues to ravage the health and economic security of millions of Americans, it is critically important to evaluate the relief efforts offered by financial institutions. And at this time, when our nation is confronted with the reality of its historic and systemic racism, it is crucial that we evaluate such relief efforts with a racial equity lens.