Report:

Saving for College During COVID-19

San Francisco's K2C Program Data Shows How COVID-19 Exacerbates Racial and Economic Inequalities

July 2020

The experience of the Kindergarten to College (K2C) Children’s Savings Account (CSA) program run by the San Francisco Office of Financial Empowerment (OFE) shows that despite economic hardship as a result of the COVID-19 crisis, families remain committed to saving for college. Program savings declined, though remarkably few families have requested emergency withdrawals, and families remain engaged with program activities. K2C’s experience with COVID-19 underscores the power, durability and importance of K2C and other CSA programs. Policymakers and advocates must continue to advocate for CSA programs that meet the needs of low-income communities of color, and ensure that existing programs can continue to reach out to and support families.

Background on K2C Program

In spring 2011, the City and County of San Francisco launched the first publicly funded universal Children’s Savings Account (CSA) program in the country. Kindergarten to College (K2C) opens a savings account for every child entering kindergarten in the City’s public schools, putting students on a path to college from their first day of school.

City leaders were compelled to create K2C when they learned that saving even small amounts for college can improve the odds that students will make it to college. Research shows that children with savings accounts will be up to seven times more likely to attend college than those without an account. This is true regardless of the family’s income, race, or educational attainment. Savings has other positive effects on children and their parents. Specifically, savings is linked to increases in math scores among youth; a greater sense of financial inclusion; greater financial literacy and fiscal prudence; protection against economic shocks; better health and education outcomes; and, the development of a “future orientation.”

K2C accounts have several unique features: they are opened automatically without any action needed by parents; they are universal for all students regardless of income or immigration status; they are publicly funded with each account receiving $50 seed money and additional incentives for saving; they are deposit-only meaning once families deposit funds they cannot withdraw the money except via a special request, and they are accessible via numerous deposit channels, including in-person, cash deposits (as compared to other college savings vehicles like 529 plans).

Today, over 8,000 K2C families have saved more than $5 million dollars. Families that have made at least one contribution to their children’s K2C account have saved an average of $731. 50 percent of savers qualify for free or reduced price lunch, equivalent to their representation in the school district as a whole. The annual amount saved by families in K2C has been steadily increasing year-over-year.

K2C During COVID-19

1. Savings Down, But Still Significant

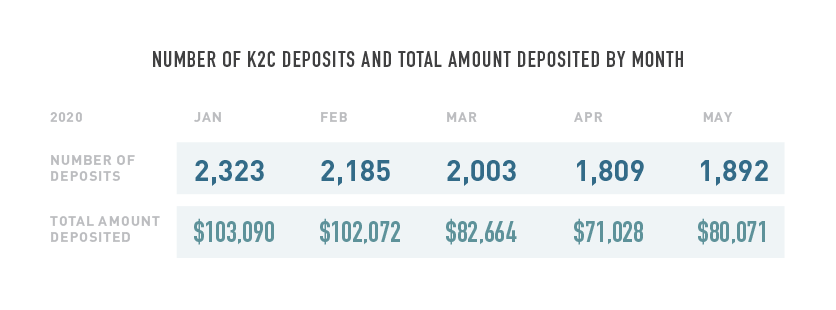

COVID-19 has upended day-to-day life and also impacted families’ savings patterns, resulting in reduced deposits. The table below outlines the number of deposits and total amount deposited from January 2020 through May 2020. The amount and number of deposits decreased sharply in March—when San Francisco’s shelter-in-place order began and then continued to fall in April—the first full month of shelter-in-place. However, deposits rebounded in May 2020, with the amount deposited up 13 percent from April to May. This increase in deposits is likely related to outreach efforts because K2C sends out activity statements with account balances to all families in May, which drives engagement.

Comparing January 2020 to April 2020 (the lowest period), the number of deposits to the K2C program were down 22 percent and the amount deposited was down 31 percent from just over $100,000 deposited in January to about $71,000 saved in April.

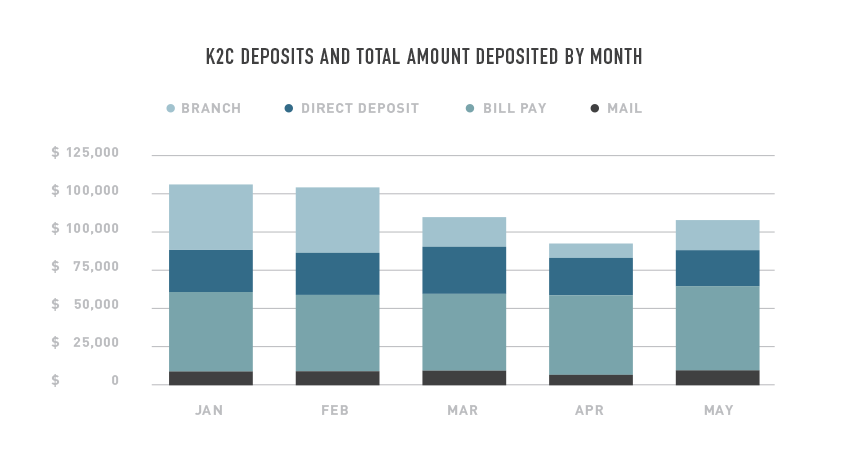

There are significant differences by deposit channel -- mail, bill pay, direct deposit and in-person. The chart below outlines the amount deposited by type for January through May 2020 -- deposits by mail and direct deposit stay relatively steady, but bill pay dips and in-person branch deposits plummet in March when shelter-in-place begins.

Not surprisingly, in-person branch deposits were the most heavily impacted with a 75 percent drop in the dollars deposited at branches in April 2020 compared to January 2020, attributed to fear of the virus, restrictions on movement and reduced branch hours. Despite the shelter-in-place order, almost 100 families still traveled to a branch and made in-person deposits in April 2020. In-person deposits rebounded significantly in May.

Usage of bill pay -- which requires families to manually make a payment online -- was down approximately 12 percent from January to April, but then almost completely rebounded in May. On the other hand, direct deposit -- which requires no parental action -- remained relatively steady from January through April but dipped 14 percent in May. This decline counters the notion that a “set it and forget it” deposit channel is recession proof. Rather, reductions in direct deposits could be a lagging indicator of an economic downturn or lost employment.

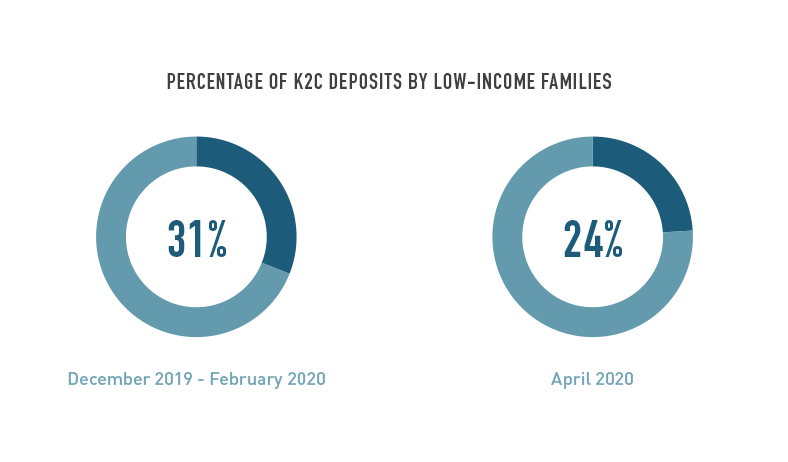

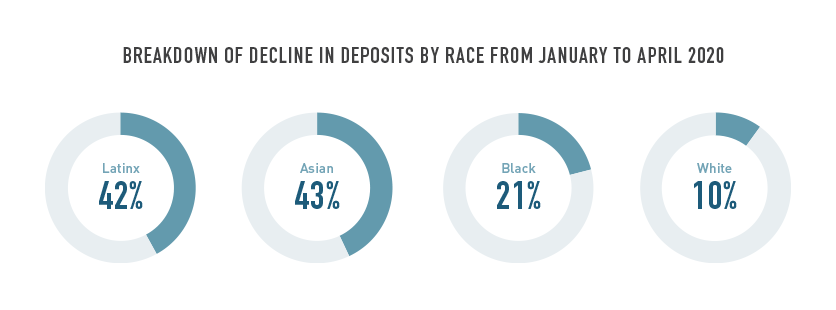

2. The Decline in Deposits is Disproportionately from Low-Income Families of Color

The biggest declines in saving came from low-income families, particularly in neighborhoods with a high concentration of Latinx and Asian residents.

The largest declines happened in lower and middle-income neighborhoods such as Visitacion Valley (94134) down 67 percent and the Sunset (94116) down 47 percent. Latinx and Asian families had the biggest declines in the number of deposits.

We know that low-income families of color are more likely to make deposits in-person at branches and in-school events—and both of these activities were largely halted during the peak of the virus in San Francisco. However, given the disproportionate impact of COVID-19 on the Latinx community in San Francisco, these reductions are concerning and outreach and support to our low-income savers of color will be an area of focus for the program in the coming weeks and months.

P. is a rising 8th grader who qualifies for the National School Lunch program and lives in the Mission District of San Francisco, a predominantly Latinx community. Her family has saved $3,535 for college so far by making over 153 trips to Citibank branches to deposit $20-$40. During the COVID-19 pandemic the family missed a few deposits due to the impacts of the virus, but in May they were back depositing funds again, committed to saving for P’s college despite the challenges they faced.

3. Families are Not Withdrawing Funds from their K2C Accounts

Despite the economic upheaval of COVID-19, very few families have requested emergency withdrawals from their K2C accounts. A unique feature of K2C accounts is that they are deposit-only. Families cannot withdraw money once it has been deposited except via a special request for emergencies. Over the ten years K2C has operated, emergency withdrawals have been very infrequent -- with approximately three withdrawals per year. So far, the K2C program has received only eight requests for withdrawals, almost triple what is usual for a year, but minimal given the severity and speed of this economic crisis. Of these eight requests, only two families have requested all the funds in their accounts. The other six have requested partial withdrawals for necessities based on job losses or to support education. One family, for example, withdrew money to buy equipment for remote learning. Additionally our data shows that even when families do withdraw funds for emergencies, they continue to save with the program moving forward. Families who have previously requested emergency withdrawals made a collective 40 deposits from January to May 2020. The limited number of withdrawals is a hopeful indicator that saving for college remains a high priority for families.

4. Families are Continuing to Actively Engage with the K2C Program

Families interact with their K2C account and the K2C program in a number of ways beyond saving: they can create or log-in to their online account, read K2C’s newsletters, participate in K2C programming and follow K2C on social media. Families are still engaging with the program in a number of different remote ways during the pandemic. For example, in April 2020, families made 18 calls to 311 asking questions about K2C compared to only five calls in April 2019. Of the families that opened our monthly newsletter in May, 20 percent of them went on to view their account balance, and a Spanish-language Facebook page for K2C created in late March already has almost 200 new followers. This non-saving engagement can help create a college-going culture and build up families' aspirations even in times when they themselves cannot save due to financial hardship.

Call to Action

Now more than ever, K2C and other CSA programs matter. The COVID-19 pandemic has created a disastrous financial crisis, especially for low- and middle-income families and communities of color who were most vulnerable before COVID-19 and now bear the brunt of the public health risk and economic fallout.

Given the economic impacts of COVID-19, state and local governments will face significant budget cuts, and long-term projects, like CSAs, may be the ones eliminated first. Policymakers, advocates and philanthropists must all unite to support and preserve the funding for CSAs.

Families are still saving and sacrificing and investing in their children’s future through CSAs.

K2C and other CSA programs must reward families’ commitments to saving by stepping up to meet the needs of the moment -- offering emergency withdrawals where necessary, diversifying our deposit channels and creatively engaging families through social media and other remote opportunities.

Finally, this is the time to redouble our efforts to engage low-income communities of color.

Throughout our history, K2C and other CSAs have worked hard to engage low-income students, and all students of color. COVID-19 has highlighted and exacerbated existing racial and economic inequalities. Meeting the needs of our low-income families of color must be our priority during COVID-19 and beyond.

Acknowledgements

The San Francisco Office of Financial Empowerment thanks San Francisco Unified School District, the Charles Stewart Mott Foundation, Citi Community Development, Citi Inclusive Finance, the California Student Aid Commission, the Walter & Elise Haas Fund, the Friedman Family Foundation, Prosperity Now and ideas42 for their support of K2C.