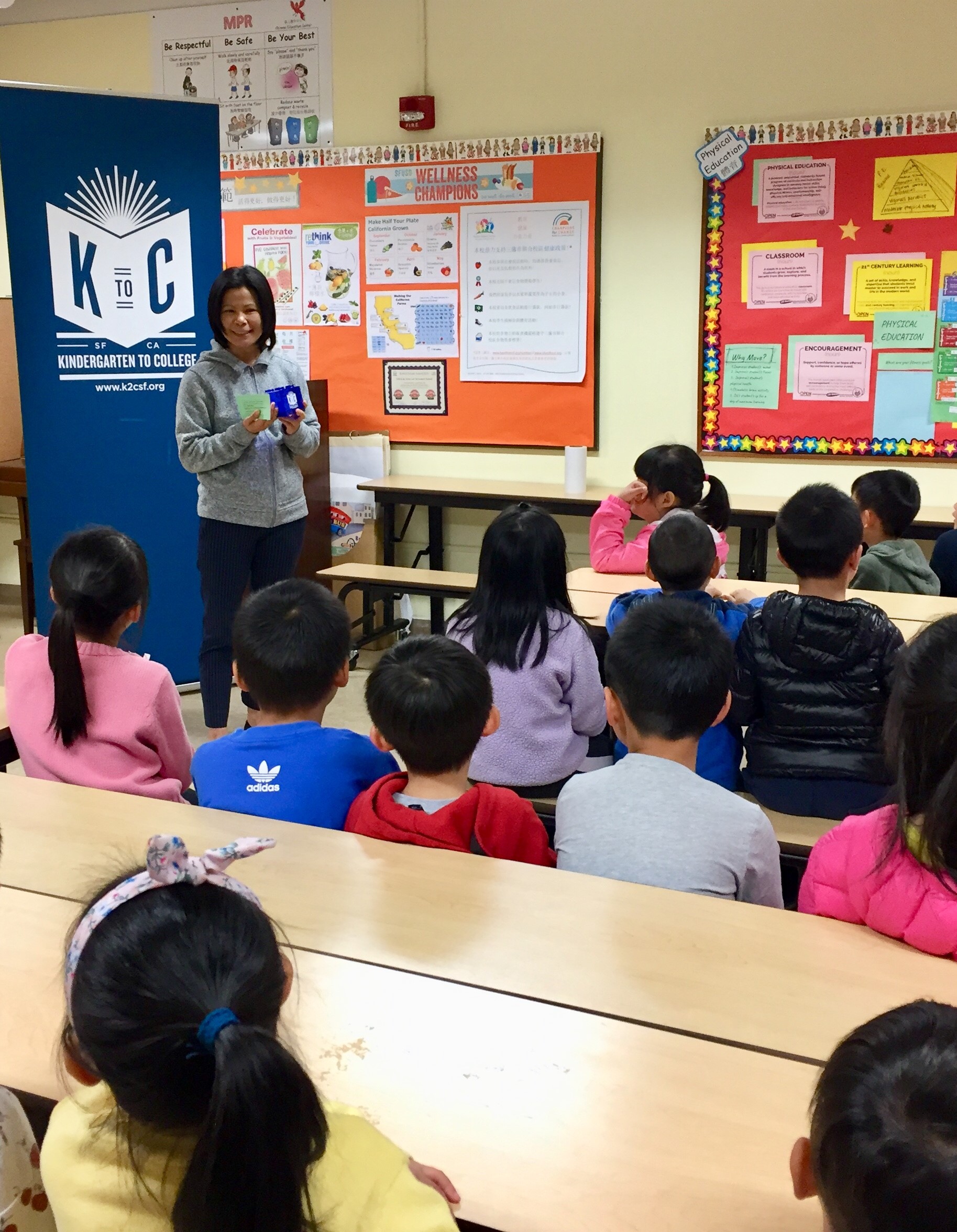

Kindergarten to College or “K2C” is the first initiative of its kind in the nation. K2C aims to improve the odds for San Francisco Kindergartners and set all San Francisco public school children on a path to college, from the very first day of school. K2C began in the Spring of 2011, when the City of San Francisco began automatically opening college savings accounts for San Francisco Kindergartners.

The idea behind Kindergarten to College is relatively simple: to help families start saving earlier and to save more, by removing barriers to opening an account and providing incentives to spur contributions. Every child entering kindergarten in a San Francisco public school has a college savings account automatically opened for them with a $50 incentive from the City and County of San Francisco. Philanthropic and corporate foundations, community organizations, local businesses, and individuals have strengthened the appeal of the program by providing funds for additional deposits and matching incentives to encourage family savings and boost account balances.

City leaders were compelled to create K2C when they learned that saving for college could make a critical difference for San Francisco students. Several key findings significantly impacted their decision:

- Savings—even small amounts—can improve the odds that San Francisco students will make it to college. Research shows that children with savings accounts will be up to seven times more likely to attend college than those without an account.1 This is true regardless of the family’s income, race, or educational attainment.

- Savings has other positive effects on children and their parents. Specifically, savings is linked to increases in math scores among youth;2 a greater sense of financial inclusion; greater financial literacy and fiscal prudence; protection against economic shocks; better health and education outcomes; and, the development of a “future orientation.”3

Today, parents, friends, extended family and the students themselves use their K2C account to save for post-secondary education. The hope is that as their savings grow, so will their aspirations. The K2C account also gives teachers a powerful real world tool to teach students about savings, financial institutions, compound interest, and budgeting.

Citations

More information

- Kindergarten to College (K2C): A First-in-the-Nation Initiative to Set All Kindergartners on the Path to College By Leigh Phillips and Anne Stuhldreher (2011)

- A Foot in the Door (video)

- Kindergarten to College: Getting all San Francisco Families to the Starting Line San Francisco Office of Financial Empowerment (2018)

- PBS Newshour clip (2019)